The question of who will serve and who will eat is one that can really make or break a family, because, one way or another, it must be settled for a long term relationship to really last. So if one partner feels they are really getting the short end of the stick, the other one should probably listen.

A stay at home mom asked the internet for advice when she came to the realization that the “stipend” her husband left her each month was not at all enough to take care of herself and two kids. However, her partner, as it turns out, felt that the money he sent her would easily be enough.

RELATED:Being a SAHP means being pretty reliant on your partner

But one SAHM felt that he husband was giving her way too little for her and their two kids

Managing money is tricky even in the best of circumstances

Financial management of a single-income household where one spouse is employed while the other is at home with the children can be challenging but rewarding. Its accomplishment is dependent on communication, shared responsibility, and a long-term focus that allows for both short-run requirements and long-term goals. But like anything in a relationship, it’s a two-way street. There has to be solid communication and an understanding of each other’s needs, otherwise, like in this story, one partner will instead go online to ask for advice.

The road to financial health begins with the creation of a complete and realistic family budget. Track all sources of income and tally all regular expenses, from housing and utilities to food and transportation. Once you understand your financial baseline, you can look for ways to reduce discretionary spending and redirect money to savings or priorities like education and health. Since the wife is the one actually managing the “home” budget, as opposed to the trips, she is the one that has the most knowledge of what is realistic or not.

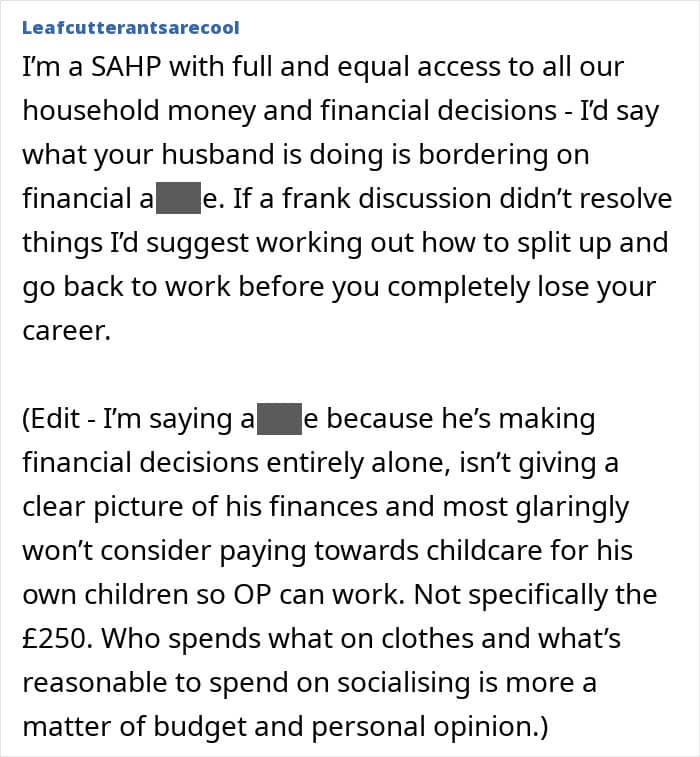

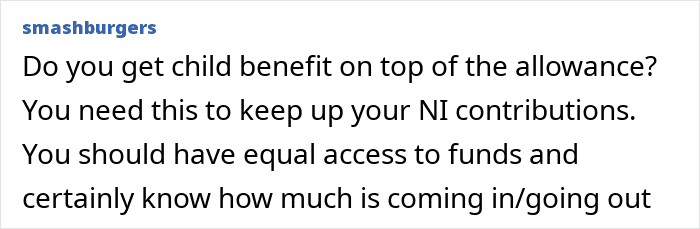

It’s vital that both partners are involved in financial decisions, regardless of who earns the income. The at-home partner has a tight grip on many aspects of home spending and has a sharp eye for where money is going out. Regular check-ins help make sure both parties feel informed and respected, and they generate a feeling of shared ownership of the family finances.

A stipend isn’t enough, there has to be long-term planning

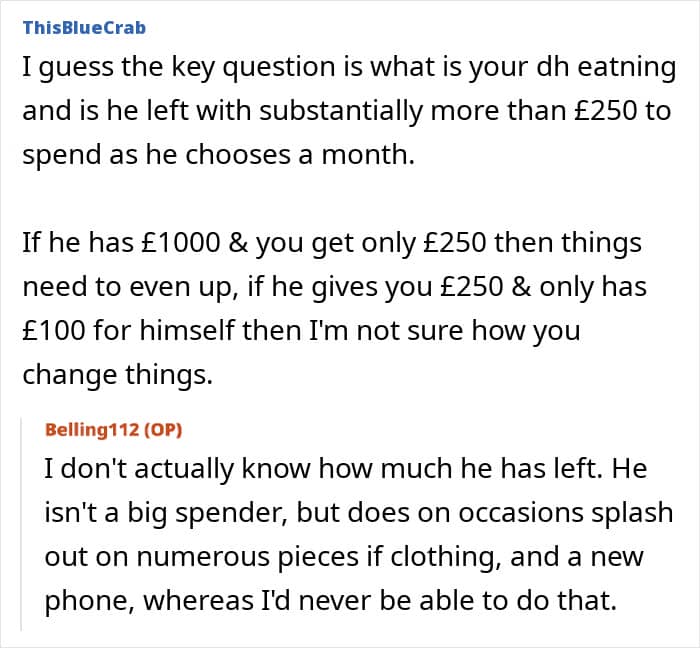

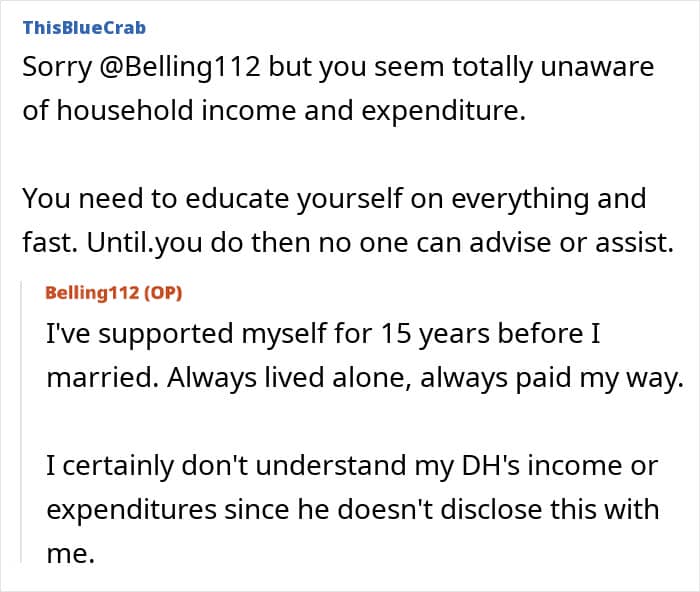

Saving should remain a priority, even on a tighter income. An emergency fund, ideally covering three to six months of living expenses, can protect the family in case of job loss, medical issues, or other unforeseen events. Start small if necessary, consistent contributions over time make a big difference. Long-term goals such as retirement and education should also be part of the conversation, even if progress is gradual. However, if one partner is just cut out of “major” decisions, this can lead to resentment and stress. In this story, the wife doesn’t even seem to know how much money the husband has to begin with.

Surviving on a single income usually means a more modest way of life, but that does not necessarily equate to doing without. Many times, families can find pleasure and bonding in inexpensive activities such as cooking together, getting outdoors, or visiting free local events. Secondhand shopping, borrowing when possible, and meal planning based on what’s on sale are commonsense strategies for making your dollars go further.

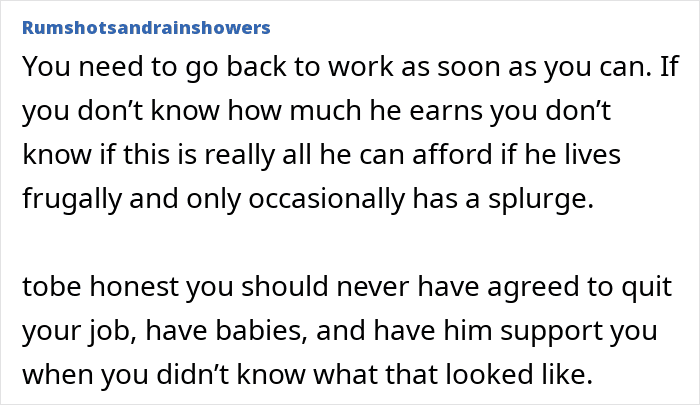

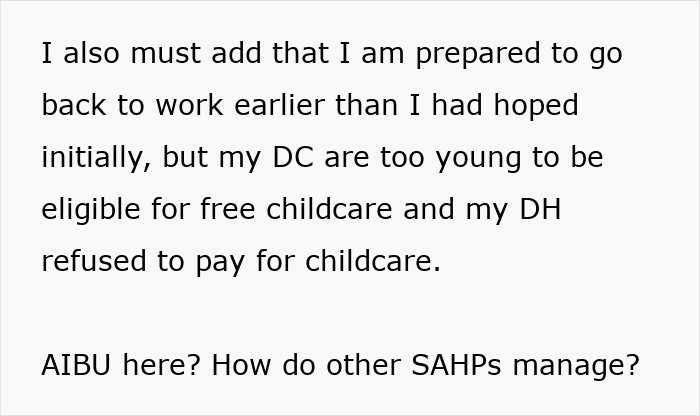

Wherever possible, the stay-at-home partner could try part-time or flexible employment to help add to the family income. With all the chances for remote working these days, it is feasible to freelance, tutor online, or set up a small business around a parenting timetable. Such initiatives, no matter how modest, have the potential to reduce financial strain and allow for some independence. Financial stability in a single-income household is less about how much you earn but about making the best use of what you have. Through teamwork, reasonable expectations, and mindful choices, families can not only get by on one income but create a secure and fulfilling life together.

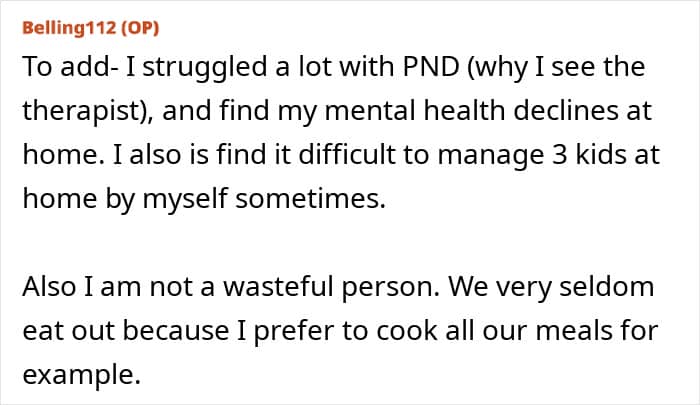

She gave some more details in the comments

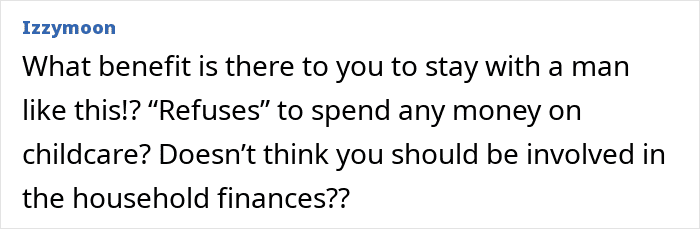

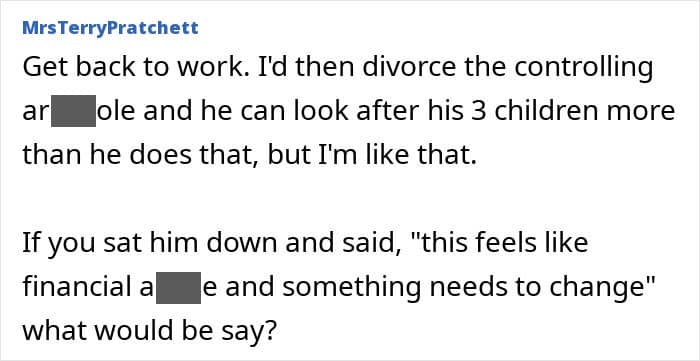

Most readers thought the husband could be more generous